Indonesia Property Loan is mortgage loan provided by Commonwealth Bank for expatriate to purchase residential house/ apartment in Indonesia or to acquire fund for consumptive purposes with property (house / apartment) as a collateral

Product Features Summary:

| Interest Rate Type | Choices of interest rate according to Customer’s needs:

|

| Currency | IDR |

| Loan Limit |

|

| Loan to Value / LTV | Credit facilities up to 90% from the collateral value based on valuation |

| Repayment | Auto Debit |

| Loan Period | Residential house/apartment: 3 – 10 years |

| Take Over Facilitiy | Transfer existing customer’s home financing from other providers to Commonwealth Bank |

| Top-Up Facility | Opportunity to have additional loan amount on the existing Commonwealth Bank Home Financing |

| Protection | Coverage by life and fire insurance |

Eligibility:

| Occupation | Employee Only | ||||

| Age |

|

||||

| Residence | any cities with Commonwealth Bank representative office (applied for residential, office/business location, and collateral | ||||

| Working Period | Minimum 2 years | ||||

| Nationality | Expatriate | ||||

| Accepted Land Title | Right to use | ||||

| * Foreigner Property Loan application with age above 55 years old can be processed until 60 years at the end of loan period if applicant can submit valid supporting document statement of retirement period from the employer | |||||

Required Documents:

Collateral Documents:

- Copy of Land Ownership Certificate (Right to Use)

- Copy of Deed of Sales & Purchase (AJB)

- Copy of Building Permit (IMB)

- Copy of the latest Land and Building Tax (PBB)

- Receipt of appraisal fee payment (for mortgaged land & building)

- Copy of Building Blue Print (if any)

Personal Documents:

- Copy of applicant’s and spouse’s ID (Passport)

- Work & stay permit (KITAS)

- Copy of Marriage Certificate or Statement of Single

- Copy of Family Card

- Copy of Tax ID or Annual Tax Payment

- Carbonized Salary Slip for the last 3 months orThe latest Salary Slip/ Company’s Statement Letter/ Work Reference include Copy of Saving Account/ Current Account for the last 3 months Copy of Building Blue Print (if any)

- Statement Letter regarding credit for property ownership and credit for consumptive purpose with property as collateral

Fees & Charges

| Provision Fee | 1% from loan value KPR Bebas = Free of charge |

| Administration Fee | 0,25% from loan value KPR Bebas = Free of charge |

| Early Repayment Fee (Full/Partial) | Will be charged in accordance with the applicable fee and will be informed to the customer through Offering Letter |

| Life Insurance Premium Fee | Follow the standard Life Insurance Premium Fee of Insurance partners and will be informed to the customer through Offering Letter |

| Fire Insurance Premium Fee | Follow the standard Life Insurance Premium Fee of Insurance partners and will be informed to the customer through Offering Letter |

| Appraisal Fee | Follow the standard Appraisal Fee of Appraisal partners |

| Notary Fee | Follow the standard Notary Fee of Notary partners |

| *

For Loan Applicant: Fees and Charges is subject to change and it will

be informed to customers through media deemed appropriate by the Bank For Existing Customer: The cost incurred will be the one stated in the Credit Agreement |

|

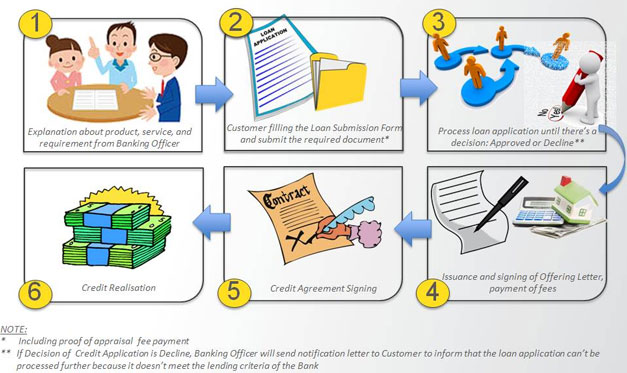

Submission Procedure :

Product Risk

The risks attached to this Foreigner Property Loan product are:

- The change of interest rates that can be done at anytime and it will be informed to customers through SMS, branches, website or other media deemed appropriate by the Bank

Installment Simulation :

Complete this fields here to estimate your loan

Other Information :

List of insurance company which has cooperation agreement with Commmonwealth Bank is as follow :

| No. | Life Insurance |

| 1. | PT. Commonwealth Life |

| 2. | PT. Panin Dai-ichi Life |

| 3. | PT. Ace Life Assurance (Chubb Life) |

| No. | Fire Insurance |

| 1. | PT. Asuransi Allianz Utama Indonesia |

| 2. | PT. Asuransi MSIG |

| 3. | PT. Asuransi Dayin Mitra |

| 4. | PT. Asuransi Sompo Japan Nipponkoa Indonesia |

For further information about Indonesia Property Loan Product, please contact:

| - | Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday). |

| - | Nearest Commonwealth Bank's branch office |

Starting from 10 August 2018, floating interest rate of Home Financing/Home Refinancing is changed to 13.99% p.a. effective.