Standby Letter of Credit (SBLC)

Standby Letter of Credit (SBLC)

Standby Letter of Creditis one of the products provided by Commonwealth Bank; i.e. written undertaking issued at the request of Customer (Applicant) to pay Beneficiary, in the case of :

SBLC is subject to UCPDC 600 or the International Standby Practices 1998 and its amendments.

Product Features

| Features | Descriptions |

| SBLC Currency | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

| SBLC Type | |

| Service Level Agreement (SLA) | Financing will be provided on the same day as long as within the facility limit and the cut of time. |

Benefits

| Benefits | Descriptions |

| Internationally acceptable | SBLC issued by Commonwealth Bank complies with international laws; namely Uniform Customs for Documentary Credit 600 or International Standby Practice 1998. Therefore it is acceptable by your counterparties all over the globe. |

| Improving company image | Generall SBLC is only granted to reputable companies with good track record. |

| Flexibility | Terms and condition of the SBLC can be tailored to fit with your business needs. |

Standby LC Issuance Process

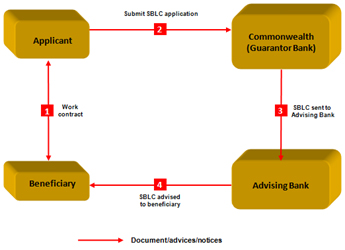

Related with the project or transaction between Customer (Applicant) and Beneficiary, Customer may request Commonwealth Bank to issue SBLC to the Beneficiary. SBLC issuance can be performed by using the facility provided by Commonwealth Bank or by customer collateral, either fixed asset or cash collateral.

Standby LC Transaction Flow

Fees

Fees related Standby LC issuance can be found here

Risk

Preparation of the terms and conditions for Standby LC claim should be able to protect the Customer’s interest, as well we to be fair to the Beneficiary. To avoid legal or other risks, you can consult SBLC terms and conditions with our experienced staffs.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).