Import Letter of Credit (LC) and SKBDN

Import Letter of Credit (LC) and SKBDN

Letter of Credit (LC), also known as Documentary Letter of Credit or Surat Kredit Berdokumen, is one of the services provided by Commonwealth Bank related to trade transaction, in form of written undertaking issued by the Bank in favour of Seller (Beneficiary) at the request of Buyer (Applicant), to make payment or acceptance in accordance with the amount mentioned and in a certain time, as long as all the documents presented are complied with the LC terms and conditions.

Surat Kredit Berdokumen Dalam Negeri (SKBDN), is a type of LC used for domestic trade transactions, both in Rupiah and foreign currencies.

Payment will be made in accordance to the instruction given by the Correspondent Bank of Seller, after Commonwealth Bank receives and ensures that goods shipping documents are complied with all terms and conditions specified in the LC/SKBDN. Payment for Sight Draft is made upon presentation of compliant documents, whereby for Usance Draft payment will be made upon the tenor specified in the LC/SKBDN.

Product Features:| Features | Description |

| Facility Type | Non-cash Facility |

| Currency Type | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

| Issuance Conditions | Submission of LC/SKBDN application form and other required documents |

| Applicable law | Import LC: Uniform Customs and Practice for Documentary Credits Publication No.600 (UCPDC 600) SKBDN: Peraturan Bank Indonesia (PBI) |

Benefits

| Benefits | Description |

| Transactional Security | Secure transaction for the Buyer (Applicant), because payment to the Seller (Beneficiary) would only be made upon presentation of shipping documents that complies with the LC/SKBDN terms and conditions |

| Capturing Opportunities | Provide transactional comfort in doing business with new business partner in an unfamiliar market |

| Financing | Issued LC/SKBDN can be used as underlying for financing request to Commonwealth Bank |

| Manage Currency Risk | Commonwealth Bank can provide LC/SKBDN issuance facility in multiple major currencies, therefore its easier for Buyer to manage currency risk |

Import LC/SKBDN Issuance Process

You can issue Import LC/SKBDN by using credit facility that we provide or by using your own funds as margin deposit. As part of Commonwealth Bank Australia Group, which is the largest provider of integrated financial services in Australia, our LC would be acceptable by your business partner worldwide.

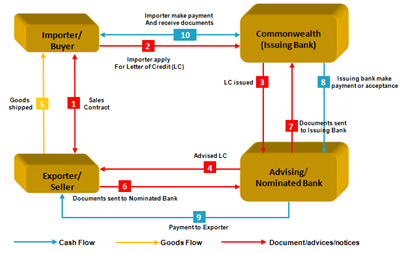

Import LC/SKBDN Transaction Flow

Fees

Fees related to Import Documentary Collection transaction can be found here

Risk

As LC/SKBDN issuer, Commonwealth Bank only guarantees payment of trade transaction upon compliance of shipping documents with the LC/SKBDN, but Commonwealth Bank does not guarantee the compliance of physical goods shipped by Seller with the information stated in the shipping documents.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 1500030 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).