Export Financing

Export Financing

Export Financing is loan facility extended by Commonwealth Bank to our customer, in this regard act as Seller / Exporter, to fulfill its working capital needs.

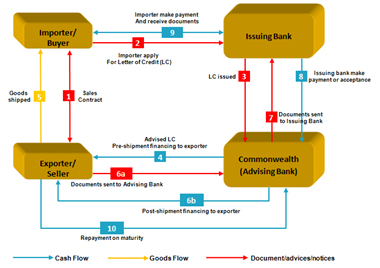

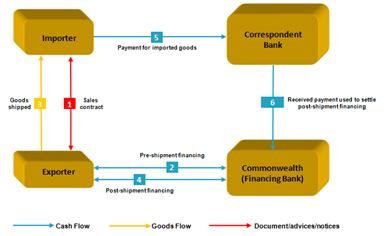

Export Financing can be granted to Customer in line with its goods sales / export activity, either based on Letter of Credit / SKBDN, Documentary Collection or Open Account.

Product Features:| Features | Description |

| Type of Export Financing | |

| Type of Currencies | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

Benefits

| Benefits | Description |

| Capture Opportunities | Fulfill your working capital needs to meet the demand for your products. |

| End-to-end Financing Scheme | Pre-Shipment Financing will be followed by Post-Shipment Financing, which mean working capital for your business will be supported by Commonwealth Bank from the early stage of production up to the payment received from Buyer. |

| Enhancing Competitiveness | Our financing can enable Seller to offer deferred payment scheme to its Buyer. |

Export Financing Application Process

Customer applies credit request to Commonwealth Bank in form of export financing facility, with reference to the valid credit procedure. Then, after the facility is approved, Customer may withdraw the loan in form of export financing up to the available credit limit, by submitting withdrawal form attached with underlying document, such as Letter of Credit / SKBDN, Outward Documentary Collection, Invoice, or the other acceptable documents.

Process Flow for Export Financing under LC

Process Flow for Export Financing Non-LC

Fees

Fees related to Export Financing can be found here

Risk

Export financing is meant to finance Customer working capital needs, as Seller, either for production process requirement or post goods delivery to Buyer. This financing is with recourse. It means, if payment failure by LC Issuing Bank or by Seller happens, the repayment obligations under this facility will remain a burden on the Customer.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).