Export Documentary Collection (EDC)

Export Documentary Collection (EDC)

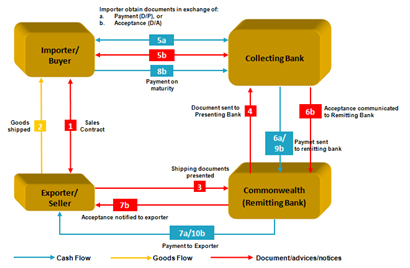

Export Documentary Collection (EDC) is the service provided by Commonwealth Bank in relation to trade transaction without Letter of Credit, where Bank at the request of Seller (Exporter) will perform payment collection to Buyer (Importer) through Correspondent Bank / Collecting Bank in the Buyer’s country.

Commonwealth Bank as the Remitting Bank will send collection instruction and shipping documents to Correspondent Bank or Collecting Bank to be dispatched further to Seller. Different with Letter of Credit, in Documentary Collection scheme there is no payment guarantee by Correspondent Bank or Collecting Bank upon presentation of shipping documents.

Product Features:| Features | Descriptions |

| Types of Export Documentary Collection | Notes:Type of documentary collection (DP or DA) instructed to Bank generally refers to agreement between Seller and Buyer. |

| Types of Currencies | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

| Same-day Processing | Export Documentary Collection received by Bank within daily transaction cut-off-time will be process on the same day. |

Benefits:

| Benefits | Descriptions |

| Transactional Security | Commonwealth Bank handles shipping documents exclusively since being received from Seller until payment of the documents is made. Seller will be more secured, as the entitlement of goods shipped would only be transferred to the Buyer upon payment or acceptance of the draft amount. |

| Cost Effective | Transaction fee is lower as opposed to payment by Letter of Credit. |

| Financing Opportunity | Seller can request financing from Bank, to obtain funds before the payment from Buyer is received. |

Export Documentary Collection Application Process

Customer to submit Document Presentation Form and Bill of Exchange (Draft) as reference for Commonwealth Bank to send collection instruction to the Correspondent Bank or Collecting Bank. Once the draft is honored by Buyer, Correspondent Bank through Commonwealth Bank would remit the funds to Seller’s account as instructed.

Export Documentary Collection Transaction Flow

Fees

Fees related to Export Documentary Collection transaction can be found here

Risk

As opposed to Letter of Credit that is a payment guarantee from the Issuing Bank to Seller, the Documentary Collection scheme does not guarantee that payment of shipping documents is to be made by Buyer. However, the entitlement of goods will not be transferred from Seller to Buyer before the shipping document is paid.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).