Letter of Credit / SKBDN Advising

Letter of Credit / SKBDN Advising

Letter of Credit (LC) / SKBDN Advising is one of the services provided by Commonwealth Bank to advise LC received from the Issuing Bank or First Advising Bank, in line with trade transaction between Buyer with Customer, who is acting as Seller.

Commonwealth Bank as the Advising Bank can support your business to help ensure the validity of LC or SKBDN message received from the Issuing Bank.

Product Features

| Features | Description |

| Types of LC Advise | |

| Types of Currency | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

| Same-day Processing | The process of LC / SKBDN advising to Seller is to be performed immediately on the same day, as long as the LC / SKBDN received within Bank daily transaction cut-off-time. |

Product Benefits

| Benefits | Description |

| Minimizing Risk | Risk of fraudulent can be reduced, as LC / SKBDN is received directly from Issuing Bank or First Advising Bank under authenticated message, through exclusive SWIFT network. |

| Cost Effective | Commonwealth Bank offers competitive LC / SKBDN advising fee. |

| Financing options | LC received can be used by Seller as underlying for pre-shipment financing or post-shipment financing request. |

| Increased Payment Security | Whenever stated in the LC / SKBDN clause, Commonwealth Bank could help Seller to obtain LC / SKBDN payment by negotiation, where Bank will ensure the shipping document compliance with the LC / SKBDN terms and conditions. |

LC / SKBDN Advising Process

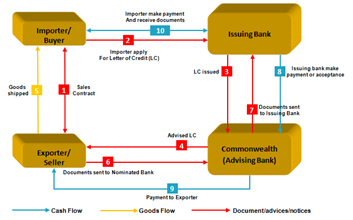

Issuing Bank or First Advising Bank upon request of Buyer will remit the LC / SKBDN electronically via SWIFT (Society for Worldwide Interbank Financial Telecommunication) network to Commonwealth Bank. Commonwealth Bank, as the Advising Bank, will convey the LC / SKBDN by letter to Customer as the Seller. After which, Customer may perform goods delivery process in accordance with the LC / SKBDN terms and conditions.

Whenever stated that the LC / SKBDN is negotiable at Commonwealth Bank (or at all banks within Indonesia), the Customer as Seller may negotiate or collect LC / SKBDN through Commonwealth Bank.

LC / SKBDN Advising Transaction Flow

Fees related to Import Documentary Collection transaction can be found here

Risk

Shipping / delivery documents which are not complied with LC / SKBDN terms and conditions may cause operational risk; i.e. cancelation of the Issuing Bank payment obligation. To mitigate the risk Commonwealth Bank provides checking service for documents negotiated through Commonwealth Bank. However, the risk of dishonor shipping / delivery documents is still possible, i.e. whenever the Issuing Bank of LC / SKBDN is claimed bankrupt.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).