Import Financing

Import Financing

Import Financing, under the product name of Post Import Financing (PIF), is Commonwealth Bank loan facility offered to Customer, who in this regard acts as Buyer / Importer, to finance its purchase of goods.

Post Import Financing can be granted to Customer in line with its goods purchase / export activity, either by using Letter of Credit, SKBDN or Documentary Collection.

Product Features:| Features | Description |

| Drawdown Underlying | Document claim from Nominated Bank / Remitting Bank for settlement of Import LC, SKBDN or Import Documentary Collection. |

| PIF Currency | IDR, USD, AUD, SGD, EUR, GBP, HKD, JPY, NZD, CNY |

| Financing Amount | Financing up to 100% value of LC, SKBDN or Documentary Collection |

Benefits

| Benefits | Description |

| Managing working capital / cash flow | Post Import Financing can help Customer (Importer) in managing working capital / cash flow since payment claim from Seller is received until the funds from import goods sales are available. |

| Improving trust | Post Import Financing helps Customer (Importer) to fulfill payment obligation to Seller timely, hence it improves the Seller trust to your business. |

| Tailor made solution | Import financing solution provided by Commonwealth Bank is tailored to fit with your business cycle or cash flow. |

Post Import Financing Application Process

Customer may apply credit request to Commonwealth Bank in form of import financing facility, with reference to the valid credit procedure. Then, after the facility is approved, Customer may withdraw the loan in form of Post Import Financing up to the available credit limit, based on claim document received from LC / SKBDN Issuing Bank or Documentary Collection Remitting Bank.

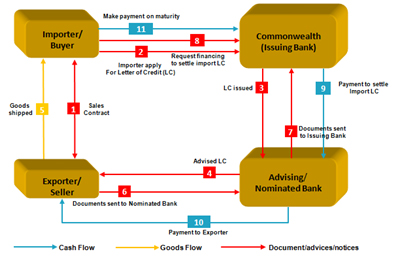

PIF Under LC Transaction Flow

Fees

Fees related to Post Import Financing can be found here

Risk

The tenor of import financing should be adjusted to Customer sales cycle. Submission of financing with non-appropriate tenor may pose the risk of Customer incapability to pay its obligation to the Bank.

Further Information

Call CommBank can be accessed through 1500030 or (6221) 2935 2935 for international access. We serve customer 24 hours a day 7 days a week (including public holiday).